Squid and Cuttlefish Market Dynamics and Future Outlook

Recently, the Food and Agriculture Organisation of the United Nations (FAO) released a global fisheries report for the first quarter of 2024, which provides an in-depth analysis of the global cephalopod market, covering multiple dimensions such as production and supply, market trade, price trends and market outlook.

Squid Market Dynamics

I. Catch Situation

Argentina's performance was outstanding: in the first four months of 2024, Argentina's squid catch was as high as 128,000 tonnes, surging 73% year-on-year and increasing by 54,000 tonnes. Demand in the international market is favourable, with prices rising by about US$1/kg compared with last year.

PERU CUT WARNING: Peru's 2024 giant squid fishing quota was reduced by 14% from 2023 and set at 499,683 tonnes. If the quota is reached or environmental problems are encountered, the fishing season may end early.

ii. Trade Developments

Argentina's exports surge: In April 2024, Argentina's squid exports increased by 214 per cent in volume and 251 per cent in value to 23,599 tonnes and US$60.8 million.

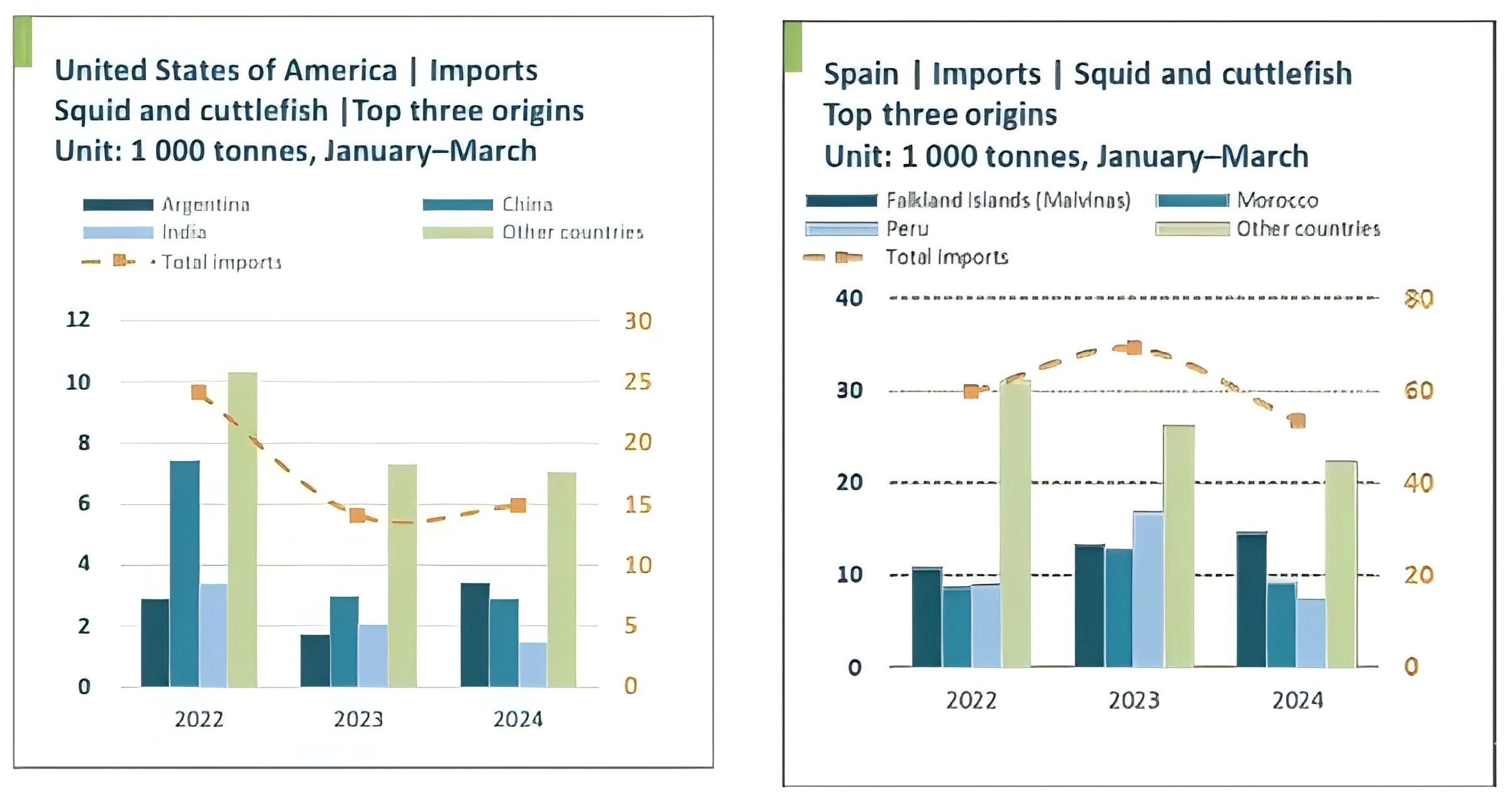

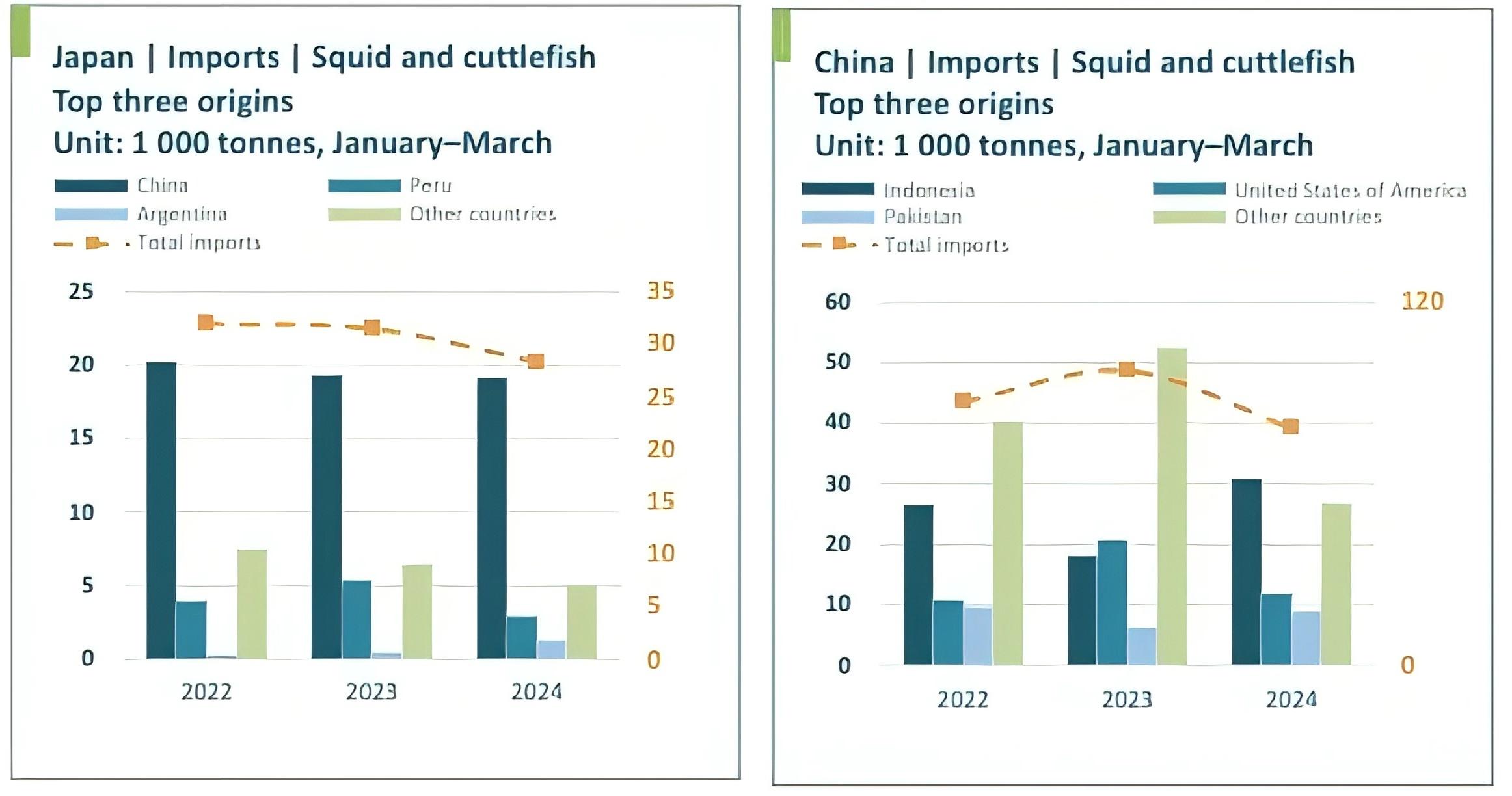

China's imports decline: In Q1 2024, China's imports of squid and cuttlefish fell by 19.5 per cent year-on-year. There was a significant shift in the supplier landscape, with Indonesia replacing Peru as the largest supplier, with exports up 70% to 30,769 tonnes. Peru, on the other hand, fell sharply by 83% to 4,612 tonnes from 27,588 tonnes in 2023, while the United States declined by almost 43% and Pakistan grew by 44%.

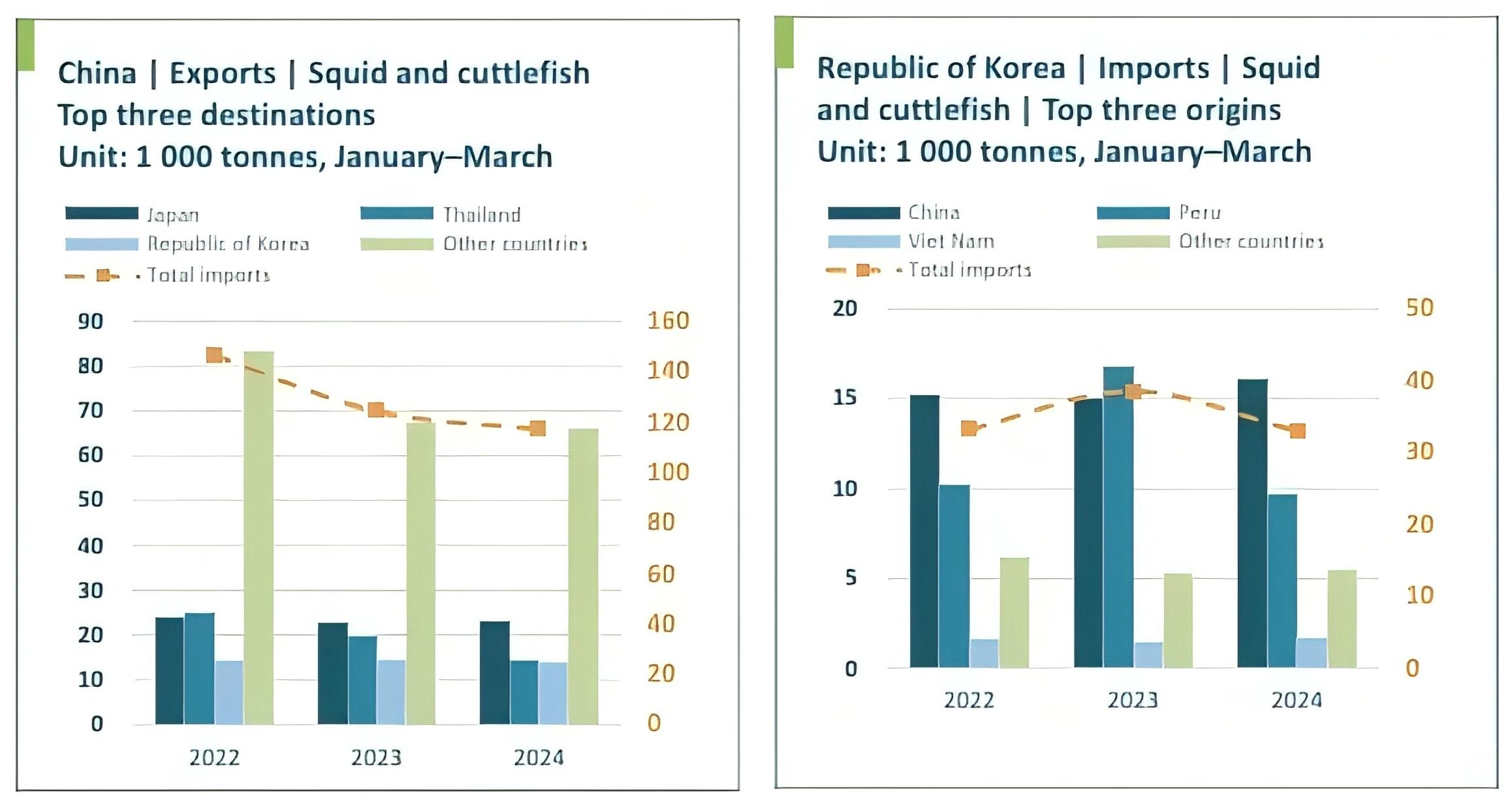

China's exports slump: Chinese squid and cuttlefish exports totalled 117,159 tonnes, down 5.6% year-on-year. Key export markets included Japan (23,101 tonnes), Thailand (14,254 tonnes) and South Korea (13,809 tonnes).

Other market changes: Japan's imports of squid and cuttlefish slipped by 10%. In particular, Peru, traditionally a major supplying country, saw a significant decrease in its supply, while Argentina's supply increased by 204%.

In the Spanish market, total imports also shrank significantly, from 69,213 tonnes to 53,509 tonnes, with the main suppliers including the Falkland Islands (also known as the Malvinas), Morocco and Peru.

South Korea, likewise, saw a 14.4% drop in imports. Chile and Argentina, on the other hand, achieved growth of 85% and 153% respectively.

Cuttlefish Market Dynamics

I. Fishing quota increase

At the end of June, Morocco announced a 19% increase in its cuttlefish fishing quota, bringing the total quota to 17,200 tonnes. Specifically, the quota for frozen octopus at sea increased by 20% to 9,828 tonnes; the quota for trawling methods increased to 1,716 tonnes; and the quota for artisanal fishing increased to 4,056 tonnes.

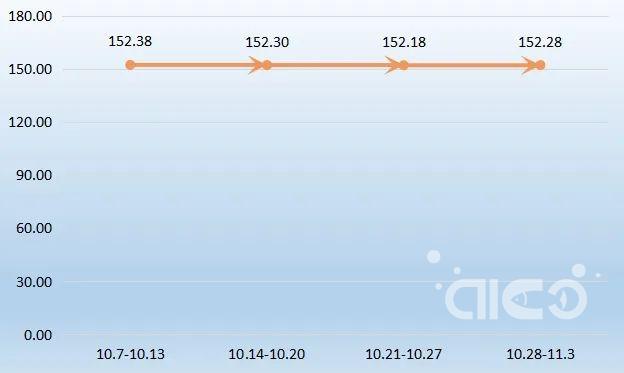

II. Price trends

At the beginning of 2024, octopus prices were well below the levels of the previous two years. However, with the end of the Mauritanian fishing season on 20 April and the depletion of stocks in the main markets, prices started to rise and are expected to remain high.

III. Trade Dynamics

Japanese market: In the first quarter of 2024, Japan's cuttlefish imports declined by 39.1% year-on-year to 6,353 tonnes from 10,436 tonnes last year. China's exports to Japan increased by 4.8%, while exports from Vietnam and Mauritania declined sharply, by 18.1%and 64.5% respectively.

KOREA MARKET: South Korea's cuttlefish imports declined by 8.6% to 15,119 tonnes this year from 16,534 tonnes last year. China's exports to Korea decreased by 13.4 %, Vietnam increased by 6.5% and Thailand decreased by 3.6%.

Future Outlook

Despite the increased supply of South American squid, prices did not fall as expected during the peak summer consumption period. Morocco's increase in cuttlefish quota is expected to improve supply, but cuttlefish prices are not expected to decrease during the summer when demand is high.

In the long run, however, the outlook for the cephalopod market remains positive as global fishery resources continue to be optimised and market demand continues to grow.